One of the stock places I frequent is at http://stockaholics.net and within that site is a live chat that uses Discord as a chat app to discuss buying and selling of stocks. Within that chat I find there are a lot of young people that are trying to get into investing with 500 to 1000 dollars to work with. They tend to gravitate towards using Robinhood as a platform since it has no transaction fees. These investors also seem to get fixated on penny stocks due to their low prices. But, penny stocks are typically the worse stocks to get into and often produce losses that end up discouraging the investor to eventually abandon stock investing.

One thing I usually chat back to them is to focus on percentage returns instead of dollars and cents. One share of a 100 dollar stock of a profitable company can easily rise to 110 dollars for a 10% gain. A 50cent stock needs to rise a nickel to get that same 10% gain but typically they are companies that lose money and can struggle to pick up that 10%.

The transaction fees are a huge consideration if you have less than $5000 in a trading account. Robinhood can often cause you issues with getting trades processed quickly and several transactions over a few days will trigger a day trading warning and not let you place trades until the trigger is lifted.

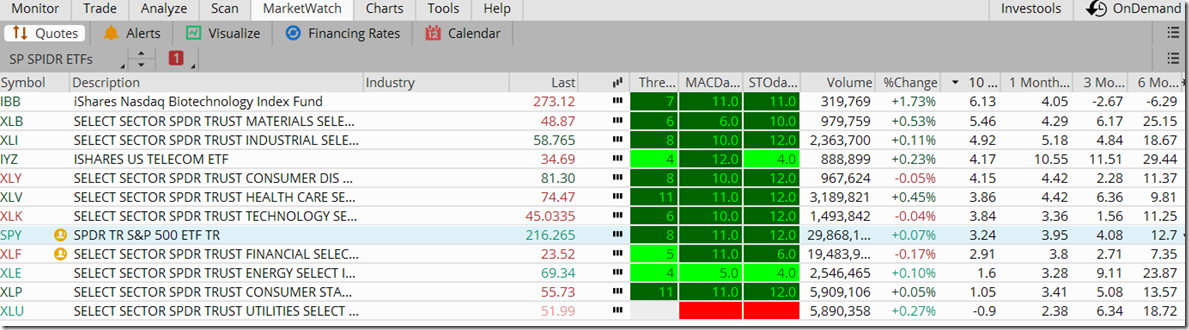

Not very well known, but perfect for low accounts is to get on to a decent trading platform that offers trading in commission free ETF’s. These allow you to trade small amounts into a diversified set of stocks with no transaction fees. It is a less risky way to invest since there is no one company to take down your account. Not that you can’t lose on them but much less risky. So, I’ve done a little research for you and here are some suggestions.

First, the one I think is the “winner” of the best place to invest if you only have $500 to $2000. You can open up an investment account with Vanguard with no minimum account balance requirement. So that 500 bucks is good to go. Then you can trade any of their Vanguard ETF’s transaction cost free. Plus they do not have a requirement to hold that ETF for 30 days as other free ETF places do. The only drawback is that you have to stay within Vanguard sponsored ETF’s but considering they have some of the best low expense fee ETF’s out there this is not much of a drawback. While a lot of the share prices are over $100 per share you simply only buy one or two shares. Then as you are able to add savings into your trading account you can gradually increase. Once you get enough built up and want to transition away from commission free ETF’s into single companies you will probably want to transfer to another broker as Vanguards transaction fees can eat you up if you are under $50,000. Here is a list of the ETF’s you can get into commission free:

https://investor.vanguard.com/etf/list#/etf/asset-class/month-end-returns

Next up is Schwab. They come in second mainly because they do have a minimum balance of $1000 when opening an account. Minor drawback as long as you have that amount to start with. They offer over 200 commission free ETF’s and do not require a 30 day hold period before selling. On their site they refer to their free ETF’s as “Schwab ETF OneSource”. Here is the list of the ETF’s they have. At the top of this list you’ll see it lists “Domestic Equity” and you have to click for International, Bond, Sector and Real Assets to see all of them

Two other’s that deserve mentioning is

Etrade (must hold 30 days or fee charged)

List of ETrade Free ETF’s

And Fidelity

(must hold 30 days or fee charged)

https://www.fidelity.com/etfs/overview

Brokerage account min 2500 Traditional IRA no min